Introduction

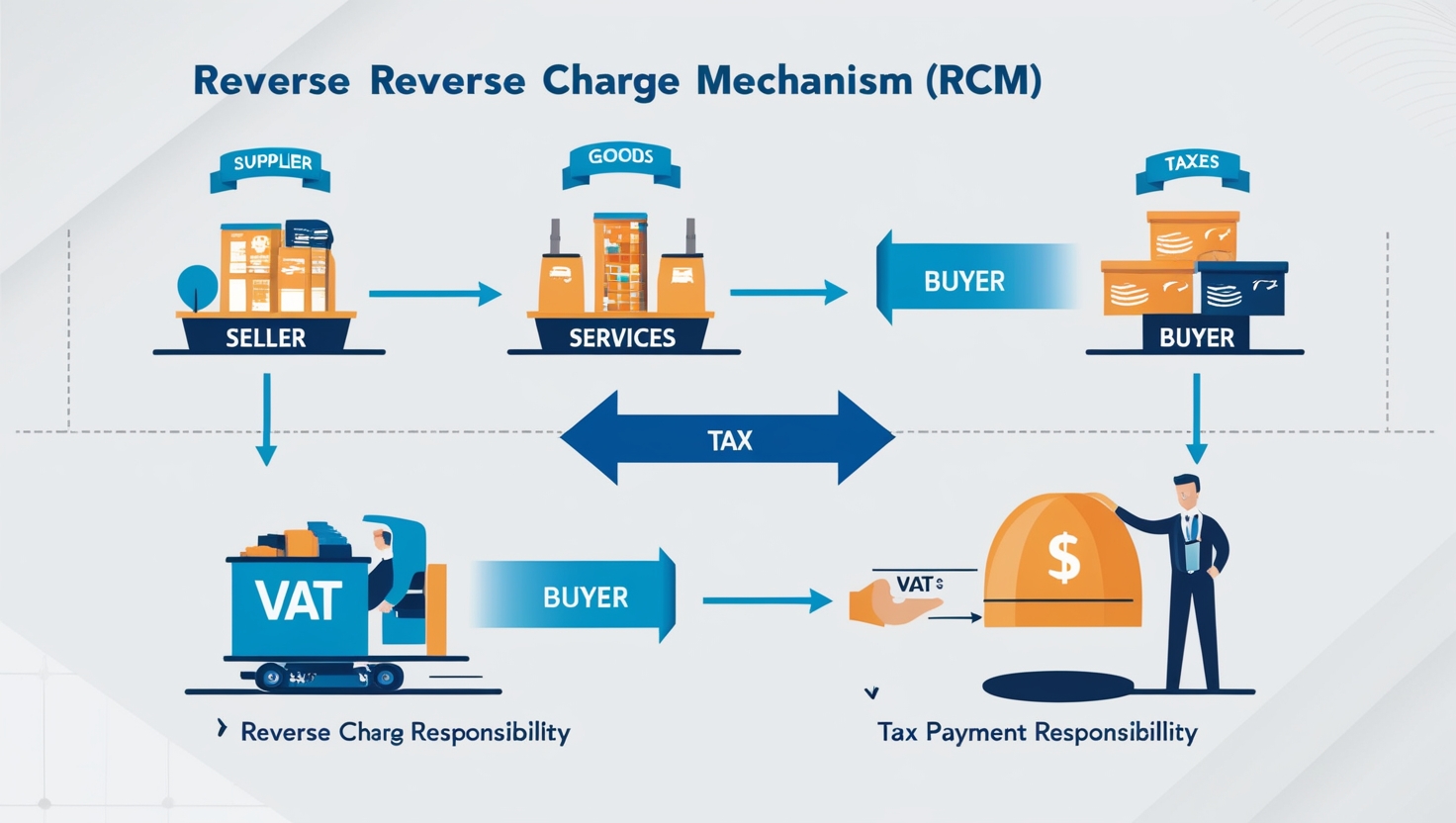

Reverse Charge Mechanism (RCM) is a concept in tax law where the responsibility to pay tax on a transaction shifts from the seller (supplier of goods or services) to the buyer (recipient of the goods or services). This is typically used in value-added tax (VAT) or goods and services tax (GST) systems.

Direct RCM is not available in Odoo, DiracERP solution has developed the auto RCM module. This module will help you to manage the reverse tax entry in journals automatically.

Key Points about RCM in Tax:

1. Applicability:

RCM is usually applied in specific situations, such as transactions involving goods or services from unregistered suppliers, certain types of imports, or specified services.

2. Tax Liability:

Under RCM, the buyer is responsible for paying the tax directly to the government, rather than the seller. This is different from the usual practice where the supplier collects the tax from the buyer and remits it to the government.

3. Compliance:

The buyer has to ensure proper compliance with RCM rules, including maintaining accurate records and filing necessary returns.

4. Common Use Cases:

In some countries, RCM is applied in sectors like construction, import of services, and transactions with unregistered entities.

RCM is commonly seen in VAT/GST systems in various countries, including India and the European Union.

User Guide

Step 1 :- Intall RCM Module

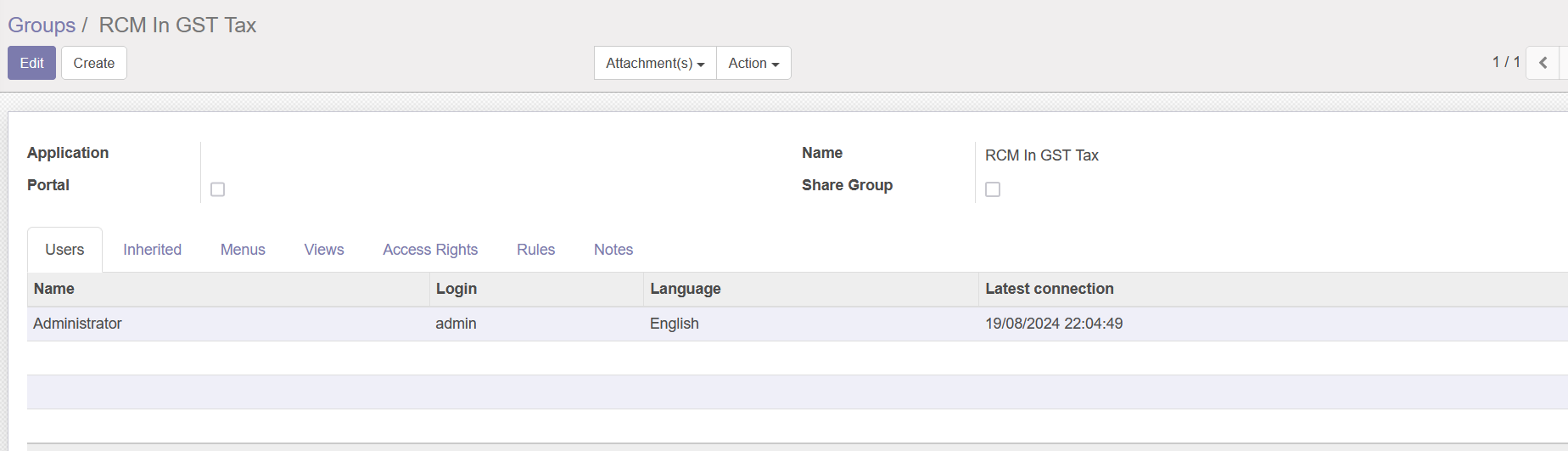

Step 2 :- Group Name :- RCM In GST Tax

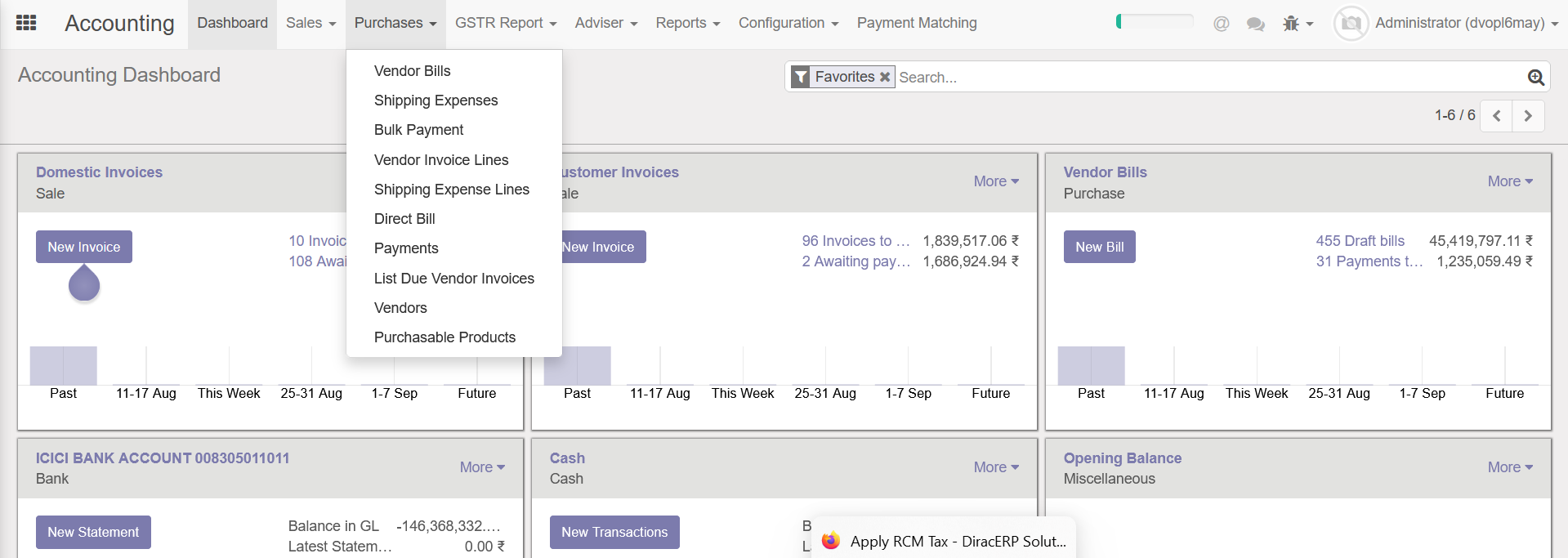

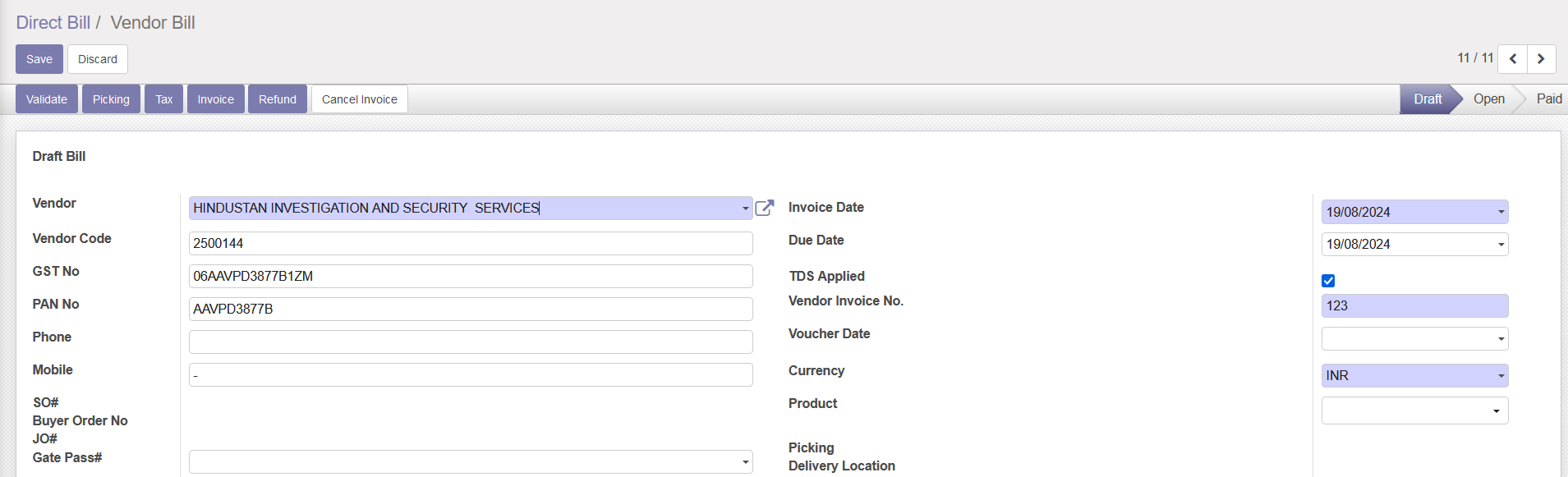

Step 3 :- Open Accounting – Purchase – Direct Bill

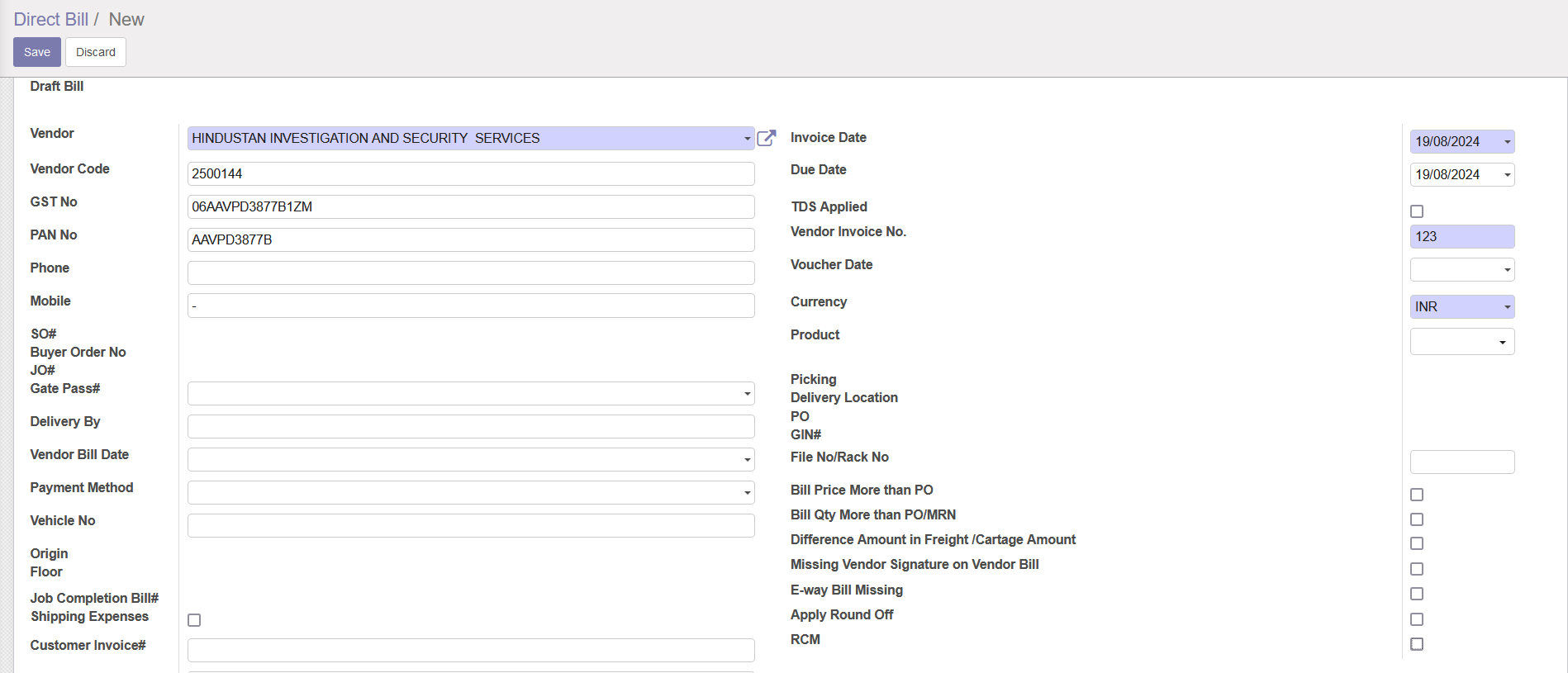

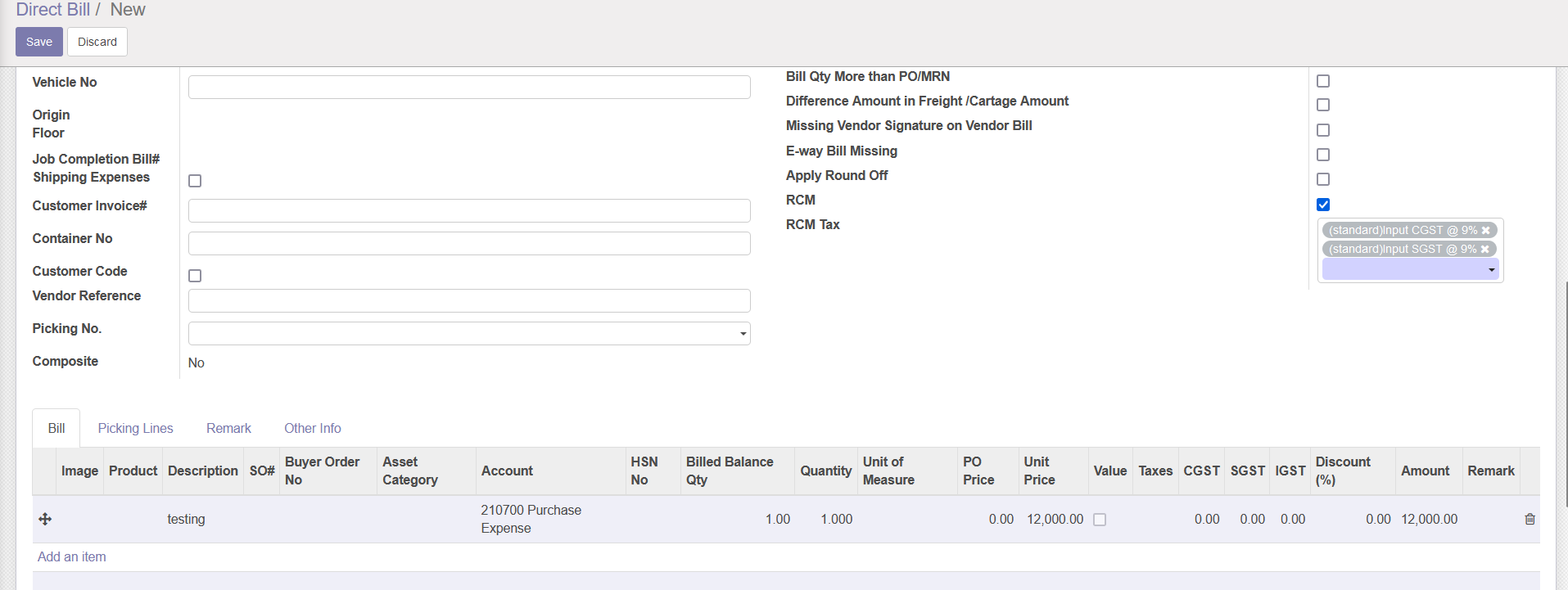

Step 4 :- Apply Rcm Tax ---tick

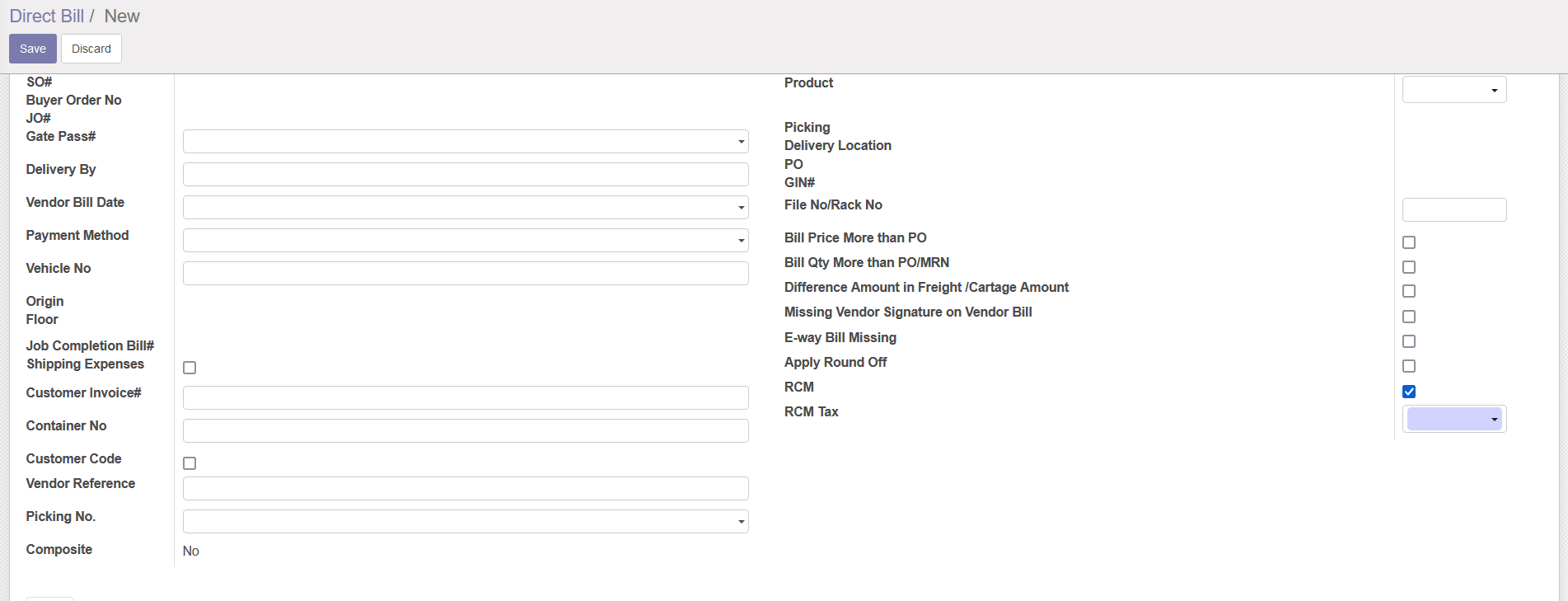

Step 5 :- After Tick – Show RCM Tax and Select the Tax Type

Step 6 :- After Apply Rcm Tax – Entry The bill line

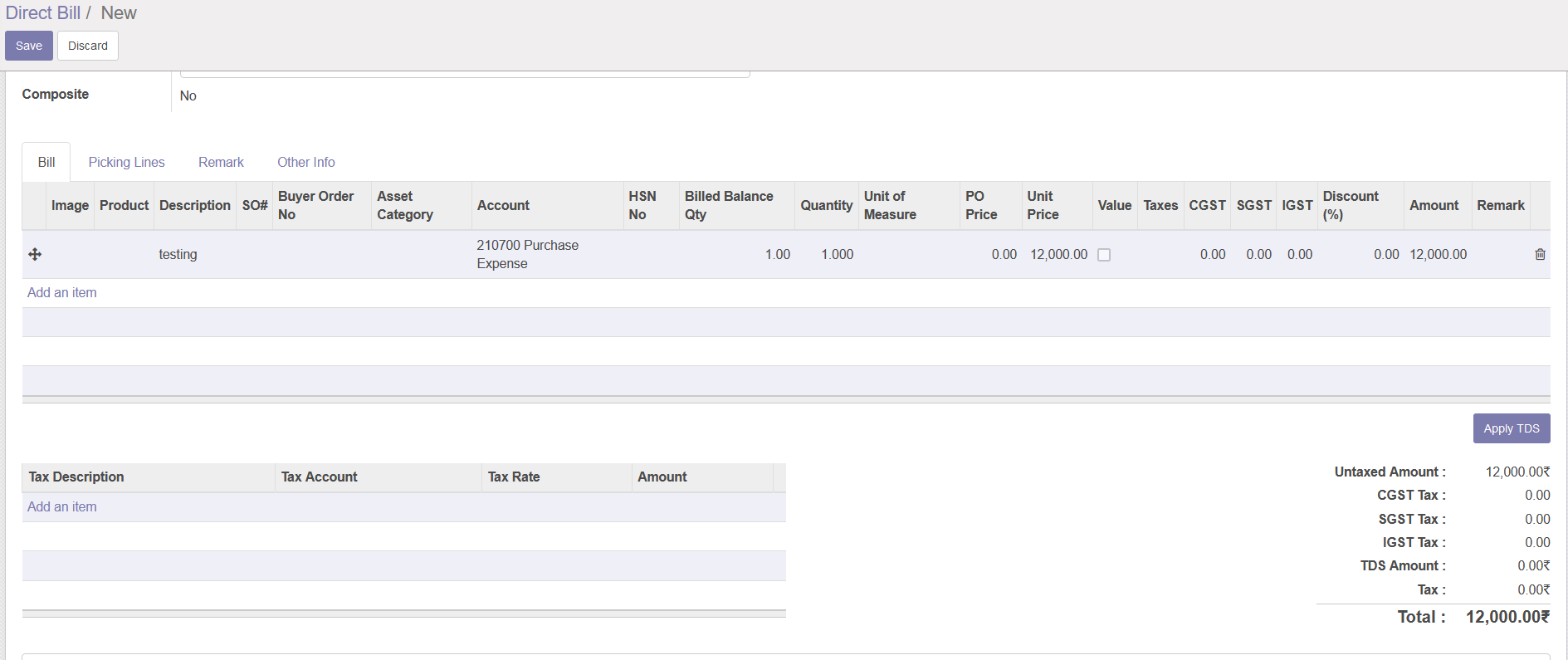

Step 7 :- Apply TDS

Step 8 :- After Apply TDS and Bill Entry , Apply Validate Button

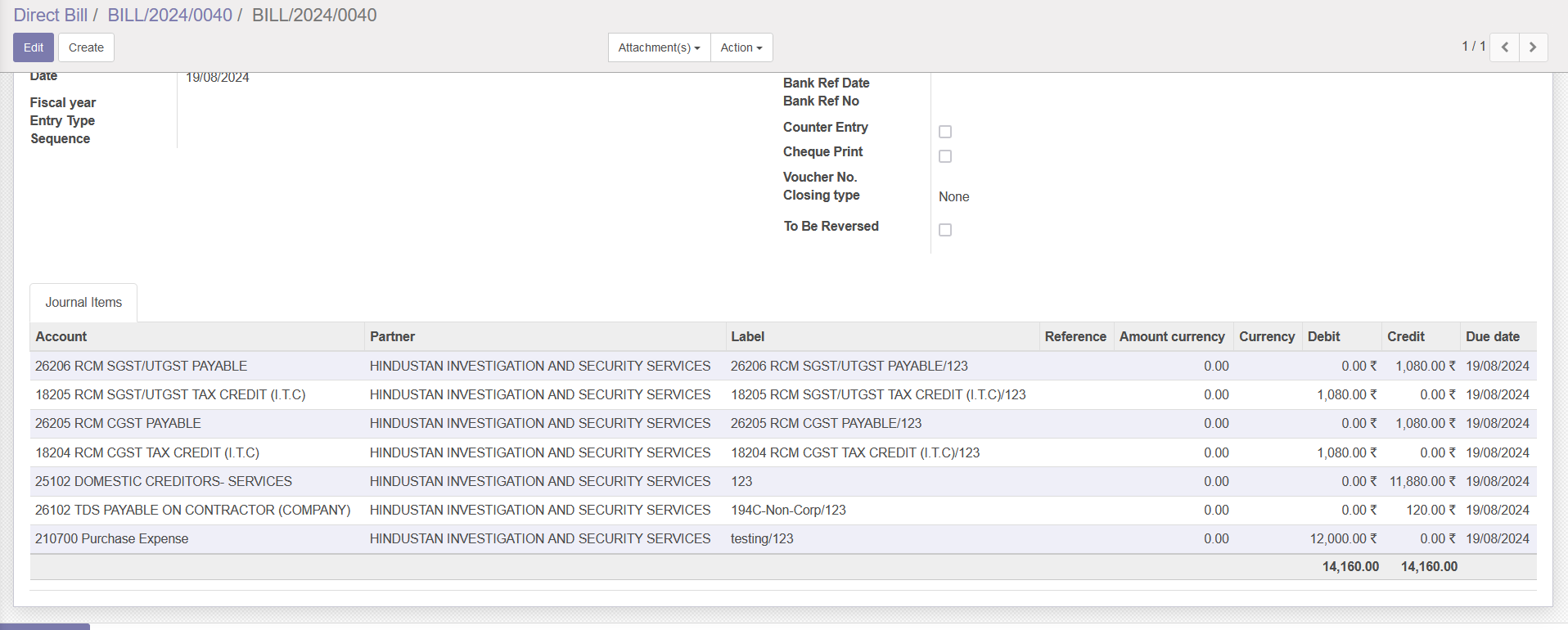

Step 9 :- Finally RCM apply and showing Entries

Conclusion

Effective financial management is crucial for all businesses to stay ahead in today’s competitive market. To streamline your financial accounts processes, you can leverage advanced financial management software solutions like DiracERP’s Financial Management Software for better control and decision-making.