Introduction

Aging reports in a financial context refers to the process of categorizing and analyzing outstanding invoices and bills based on the length of time they have been overdue. This concept is crucial for managing accounts receivable and accounts payable, as it helps businesses track overdue accounts, manage cash flow, and make informed decisions about collections and payments.

Key Aspects of Aging

1. Aging Reports:

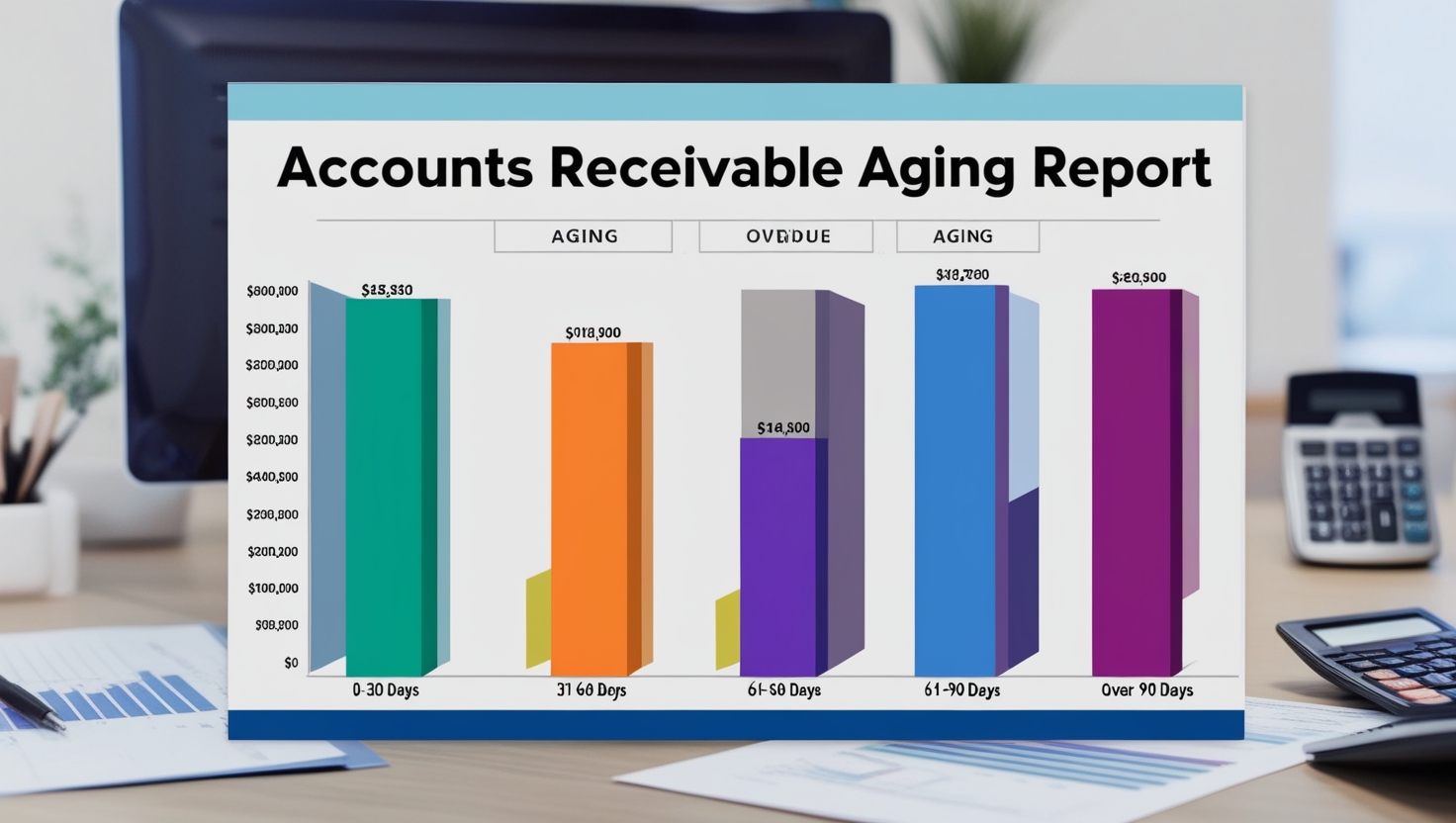

Accounts Receivable Aging Report:-

Lists outstanding customer invoices by the length of time they’ve been overdue. Common categories include:

- 0-30 days

- 31-60 days

- 61-90 days

- Over 90 days

Accounts Payable Aging Report:

Similar to the receivables report but focused on outstanding vendor bills. It helps manage payments to suppliers and ensures bills are paid on time.

2. Aging Buckets:

- 0-30 Days: Invoices or bills are up to 30 days overdue.

- 31-60 Days: Overdue between 31 and 60 days.

- 61-90 Days: Overdue between 61 and 90 days.

- Over 90 Days: Overdue for more than 90 days.

3. Purpose of Aging:

- Track Overdue Accounts: Identifies overdue invoices or bills, prompting action on collections or payments.

- Manage Cash Flow: Offers insights into upcoming cash flow needs.

- Prioritize Actions: Allows businesses to focus on accounts or bills needing immediate attention based on how long they’ve been overdue.

4. Benefits of Aging Reports

- Improved Collections: Timely identification of overdue invoices helps reduce the risk of bad debts through proactive collection efforts.

- Vendor Management: Highlights overdue bills for better management of supplier relationships, ensuring timely payments.

- Financial Planning: Aids in budgeting and cash flow forecasting by providing a clear picture of outstanding amounts.

5. How Aging Reports are Used

- Generating Reports: Accounting software like Odoo can generate aging reports on demand. These reports can be customized based on specific periods or needs.

- Reviewing Reports: Businesses typically review these reports on a regular basis (e.g., monthly) to monitor outstanding amounts.

- Taking Action: Based on the report, businesses can send payment reminders, negotiate terms, or prioritize vendor payments.

Example Scenario

A company notices several customer invoices are overdue. After running an accounts receivable aging report, they can see which customers owe money and for how long. Invoices overdue for more than 90 days would be flagged for urgent follow-up. Similarly, overdue vendor bills might be prioritized for payment to avoid late fees or disruptions in supply.

In summary, aging is a crucial financial tool that helps businesses manage their receivables and payables by providing insights into overdue amounts. This helps improve cash flow management, enhance collections, and optimize financial operations.

At DiracERP Solution , we have implemented end to end accounting and finance at large organisations.

For further information please connect with us at our website DiracERP.com or Call +91-8077-032513

+91-124-402-8674